E-mini Dow Futures - Still Expected to Rise

rhboskres

Publish date: Tue, 29 Oct 2019, 11:13 AM

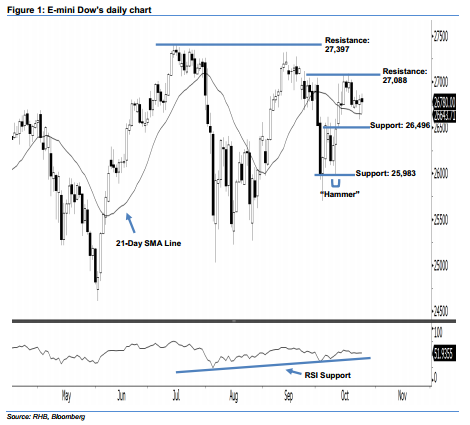

Stay long. The E-mini Dow ended lower to form a negative candle last night. It slipped 22 pts to close at 26,780 pts, after oscillating between a high of 26,872 pts and low of 26,655 pts. Based on the current technical landscape, the market sentiment remains positive as the index has stayed above the previously-indicated 25,983-pt support for two weeks. Given that the E-mini Dow is still hovering above the 21-day SMA line, this implies that the rebound that started from 10 Oct’s “Hammer” pattern may carry on. Overall, we remain upbeat on the E-mini Dow’s outlook.

As seen in the chart, we anticipate the immediate support level at 26,496 pts, ie the low of 11 Oct. The next support is maintained at 25,983 pts, determined from the low of 10 Oct’s “Hammer” pattern. On the other hand, we are eyeing the immediate resistance level at 27,088 pts, ie 17 Oct’s high. Meanwhile, the next resistance would likely be at the 27,397-pt record high.

Hence, we advise traders to stay long, following our recommendation of initiating long above the 26,750-pt level on 16 Oct. A stop-loss is advisable to set below the 25,983-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 29 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024