FCPO - Still Closing Below MYR2,400

rhboskres

Publish date: Tue, 29 Oct 2019, 08:48 AM

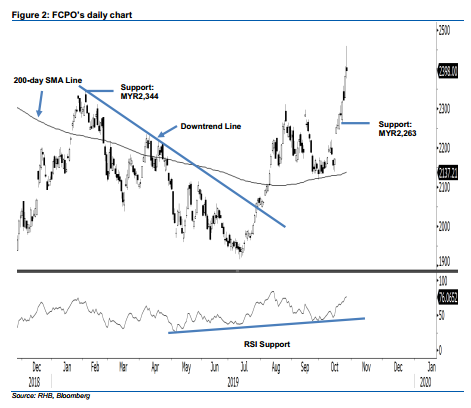

Maintain long positions as the upward move is still showing strength. The FCPO briefly tested both the resistance levels of MYR2,400 and MYR2,457 in the latest session – it reached a high of MYR2,460. At the closing, it settled at MYR2,398, indicating a gain of MYR14. While the commodity gave back most of its intraday gains and closed below the said resistance levels on the back of an overbought RSI reading, these are not sufficient to suggest its upward move has reached a top for now. To signal a possible end to the upward move, further negative price actions in the coming sessions are needed. Until this happens, we are keeping our positive trading bias.

As the upward move is still considered as intact, traders are recommended to stay in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop loss can now be placed below MYR2,263.

The immediate support is revised to MYR2,344, which was the high of 7 Feb. This is followed by MYR2,263, the low of 22 Oct. Conversely, immediate resistance is still pegged at MYR2,400, followed by MYR2,457, which was the high of 4 June 2018.

Source: RHB Securities Research - 29 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024