FKLI - Back Into a Resistance Zone

rhboskres

Publish date: Wed, 30 Oct 2019, 05:14 PM

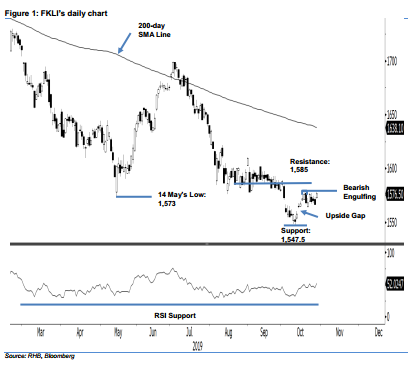

Maintain long positions to ride on the countertrend rebound. The FKLI closed 10 pts stronger at 1,576.5 pts yesterday, and trading ranged between 1,572 pts and 1,578.5 pts. The positive closing placed the index back into the resistance zone of 1,573-1,585 pts. We note that it has been undergoing a minor pause around the 1,572-pt mark over the past week. Should there be a positive follow-up in the coming sessions, chances are high that the countertrend rebound that started from the low of 1,547.5 pts would be extended. All in, we continue to favour the case for a rebound extension.

In the absence of a price reversal signal from the resistance zone, traders should remain in long positions. We initiated these at 1,565 pts, the closing level of 14 Oct. To manage risks, a stop loss can be set below 1,547.5 pts.

We are still expecting the immediate support to emerge at 1,547.5 pts, the low of 10 Oct, followed by 1,500 pts. Moving up, the immediate resistance is at 1,585 pts, near the lower boundary of the sideways move that developed between mid-August and early October. This is followed by the 1,600-pt mark.

Source: RHB Securities Research - 30 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024