E-mini Dow Futures - Slight Pullback

rhboskres

Publish date: Wed, 30 Oct 2019, 05:33 PM

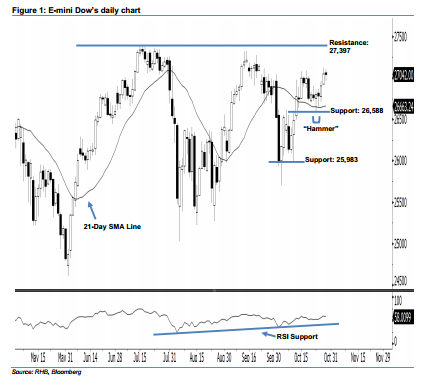

Maintain long positions. Following the white candles that were formed on 25 and 28 Oct, the E-mini Dow ended lower to form a black candle yesterday. It slipped 11 pts to close at 27,042 pts, off its high of 27,111 pts and low of 26,967 pts. Unsurprisingly, yesterday’s black candle should be viewed as a weak pullback after the recent rise. We think the bulls may continue to control the market as long as the E-mini Dow does not negate the bullishness of 23 Oct’s “Hammer” pattern. Overall, we remain upbeat on the index’s outlook.

Based on the daily chart, the immediate support level is seen at 26,588 pts, ie the low of 23 Oct’s “Hammer” pattern. If this level is taken out, look to 25,983 pts – which was the previous low of 10 Oct – as the net support. On the other hand, we anticipate the immediate resistance level at the 27,397-pt record high. The next resistance would likely be at the 28,000-pt psychological mark.

Hence, we advise traders to maintain long positions, since we had originally recommended initiating long above the 26,750-pt level on 16 Oct. At the same time, a trailing stop set below the 26,588-pt threshold is advisable in order to minimise the risk per trade.

Source: RHB Securities Research - 30 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024