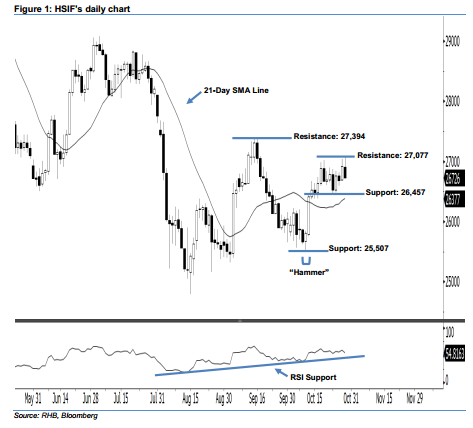

Hang Seng Index Futures - Still Above the 21-day SMA Line

rhboskres

Publish date: Wed, 30 Oct 2019, 05:37 PM

Stay long while setting a trailing stop below the 26,457-pt support. The HSIF ended lower to form a black candle yesterday. It dropped to a low of 26,717 pts during the intraday session, before ending at 26,726 pts for the day. However, yesterday’s black candle can be viewed as a result of profit-taking activities following the recent gains. Technically speaking, the positive sentiment would remain intact as long as the index does not erase the gains from 24 Oct’s white candle. Overall, we believe the market’s rebound, which began from 10 Oct’s “Hammer” pattern, may persist.

As seen in the chart, the near-term support level is seen at 26,457 pts, ie the low of 23 Oct. This is followed by 25,507 pts, determined from the low of 10 Oct’s “Hammer” pattern. Towards the upside, we are now eyeing the immediate resistance level at 27,077 pts, ie 29 Oct’s high. If a breakout arises, the next resistance is anticipated at 27,394 pts, obtained from the high of 16 Sep.

Therefore, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,150-pt level on 16 Oct. A trailing stop can be set below the 26,457-pt mark in order to limit the downside risk.

Source: RHB Securities Research - 30 Oct 2019