WTI Crude Futures - Bulls May Have Hit the Wall

rhboskres

Publish date: Wed, 30 Oct 2019, 05:39 PM

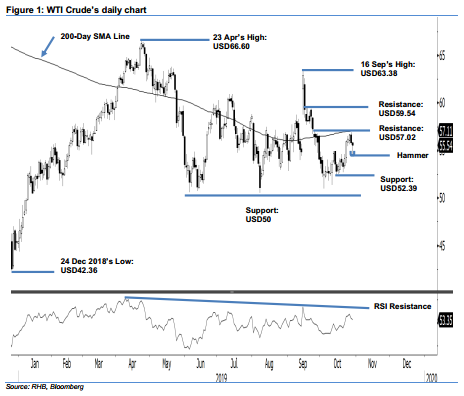

Initiate short positions as the countertrend rebound play may have reached a top. The WTI Crude ended the latest session to close USD0.27 weaker at USD55.54. Trading took place between USD54.61 and USD55.91, a “Hammer” candlestick pattern also emerged. The negative session crossed the previous session’s low of USD55.58 – thus signalling a good possibility that the countertrend rebound, that started from an area near the immediate support of USD50, has reached a peak. It took place after the commodity came in near to test both the 200-day SMA line and the immediate resistance of USD57.02 – indicating a potential price rejection. Switch our trading bias to negative.

Our previous long positions initiated at USD53.55, which was the closing level of 10 Oct, were closed out in the latest sessions at USD55.58. On the bias that the countertrend rebound may have reached a top, we initiate short positions at the latest closing level. For risk management purposes, a stop-loss can be placed above USD57.02.

Immediate support is set at USD52.39, or the low of 12 Oct. This is followed by USD50.00, a round figure. Moving up, the immediate resistance is pegged at USD57.02, ie the high of 25 Sep. This is followed by USD59.54, which was the high of 19 Sep.

Source: RHB Securities Research - 30 Oct 2019