E-mini Dow Futures - Upward Momentum Resumes

rhboskres

Publish date: Thu, 31 Oct 2019, 04:30 PM

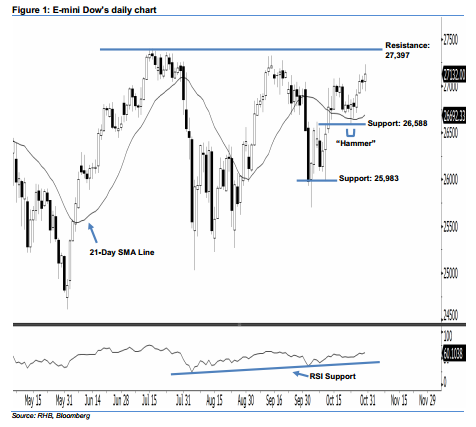

Stay long, with a trailing stop set below the 26,588-pt support. The E-mini Dow formed a white candle last night. It rose 90 pts to close at 27,132 pts, off the session’s high of 27,230 pts and low of 26,940 pts. From a technical viewpoint, the bullish trend is likely to continue. This was after the index recouped the previous day’s losses and marked a higher close above the rising 21-day SMA line. Furthermore, as the 14-day RSI indicator turned higher for a better reading at 60.10 pts as of yesterday, the bullish sentiment has been enhanced.

Based on the current outlook, we anticipate the immediate support level at 26,588 pts, which was the low of 23 Oct’s “Hammer” pattern. The next support is seen at 25,983 pts, obtained from the previous low of 10 Oct. Towards the upside, the immediate resistance level is maintained at the 27,397-pt historical high. Meanwhile, the next resistance is situated at the 28,000-pt psychological spot.

Thus, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 26,750-pt level on 16 Oct. A trailing stop set below the 26,588-pt mark is preferable in order to minimise the downside risk.

Source: RHB Securities Research - 31 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024