Hang Seng Index Futures - Outlook Stays Positive

rhboskres

Publish date: Thu, 31 Oct 2019, 04:33 PM

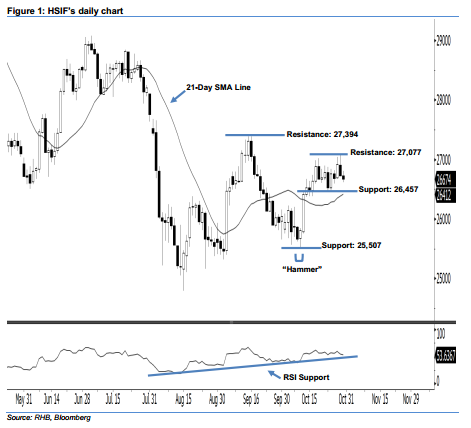

Stay long. The HSIF formed another black candle yesterday. It closed at 26,674 pts, after oscillating between a high of 26,805 pts and low of 26,616 pts. Still, we believe the upside move is not over yet, as the index continues to hover above the 21-day SMA line. Yesterday’s black candle was the result of profit-taking activities after the recent gains, in our view. Technically, the 21-day SMA line will likely begin turning upwards – this suggests that there is a likelihood of increased buying momentum in the coming sessions. Overall, the market trend remains positive.

According to the daily chart, we are eyeing the immediate support level at 26,457 pts, which was 23 Oct’s low. The next support would likely be at 25,507 pts, ie the low of 10 Oct’s “Hammer” pattern. On the other hand, we anticipate the immediate resistance level at 27,077 pts, obtained from the high of 29 Oct. Meanwhile, the next resistance is maintained at 27,394 pts, defined from 16 Sep’s high.

Hence, we advise traders to maintain long positions, given that we initially recommended initiating long above the 26,150-pt level on 16 Oct. In the meantime, a trailing stop can be set below the 26,457-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 31 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024