FKLI - Holding Up Well

rhboskres

Publish date: Thu, 31 Oct 2019, 04:37 PM

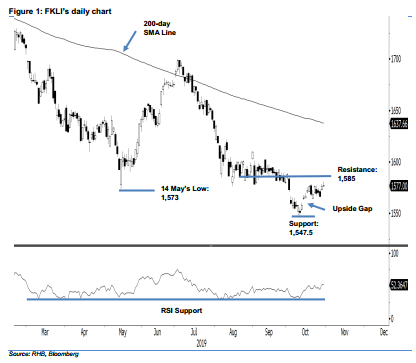

Maintain long positions, as the rebound will likely be extended. The FKLI closed 0.5 pt higher yesterday, at 1,577 pts, after recording a low and high of 1,576 pts and 1,581 pts. We believe the intraday high has also invalidated 18 Oct’s “Bearish Engulfing” formation. The latest performance indicates the index is not experiencing a possible price rejection from the resistance zone of 1,573-1,585 pts. Overall, we still believe the index’s countertrend rebound – which started from the low of 1,547.5 pts – is still likely to be extended further. We maintain our positive trading bias.

As the bulls are still standing strong, traders should remain in long positions. We initiated these at 1,565 pts, the closing level of 14 Oct. To manage risks, a stop loss can be set below 1,547.5 pts.

We still expect the immediate support to emerge at 1,547.5 pts, the low of 10 Oct, followed by 1,500 pts. Conversely, the immediate resistance is at 1,585 pts, near the lower boundary of the sideways move that developed between midAugust and early October. This is followed by the 1,600-pt mark.

Source: RHB Securities Research - 31 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024