FCPO - Bulls Pushing Ahead

rhboskres

Publish date: Thu, 31 Oct 2019, 04:38 PM

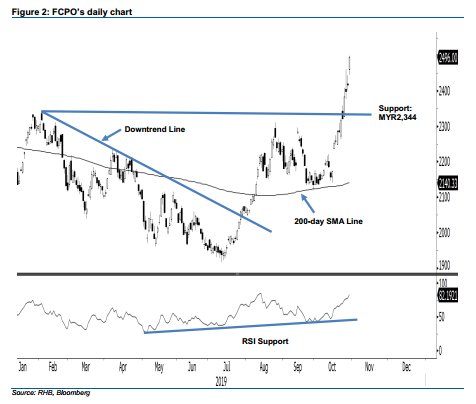

Nearing the next resistance; maintain long positions. The FCPO chalked up a strong session yesterday, closing MYR79 higher at MYR2,496. This means the commodity has breached upwards past the previous immediate resistance of MYR2,457, and came close to testing the MYR2,500 mark. The low and high were at MYR2,445 and MYR2,499. The strong performance still means that the bulls are in firm control of the multi-month uptrend, even though the RSI reading indicates an overbought condition. Until price reversal signals emerge, we maintain our positive trading bias.

As the bulls still control the price trend, traders should stay in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop loss can now be placed below MYR2,328.

The immediate support is revised to MYR2,400, followed by MYR2,344, the high of 7 Feb. Moving up, immediate resistance is now expected at MYR2,500, followed by MYR2,568, the high of 1 March 2018.

Source: RHB Securities Research - 31 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024