WTI Crude Futures - Bears Are in Control

rhboskres

Publish date: Fri, 01 Nov 2019, 09:03 AM

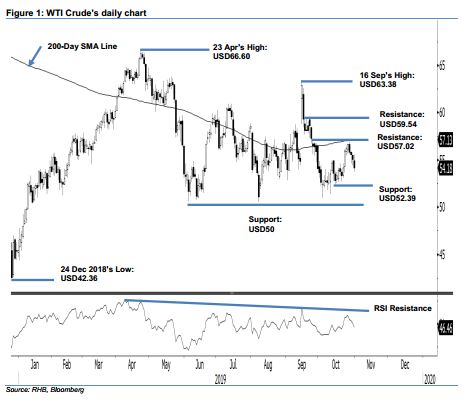

Maintain short positions as the retracement is not showing signs of abating. The WTI Crude continued to trade on a soft note. At the closing it surrendered USD0.88 to close at USD54.18. Trading ranged between USD53.71 and USD55.59. The weak session is suggesting the retracement that kicked in on the failed attempt to cross the 200-day SMA line and the immediate resistance of USD57.02 recently, is still progressing. The RSI reading, which is curving downward, also indicates a weak bias. In the absence of a price signal to mark an end to the downward move, we keep to our negative trading bias.

As the bears are still having control over the retracement, we continue to recommend traders stay in short positions. For risk management purposes, a stop-loss can now be placed at the breakeven level.

Towards the downside, immediate support is pegged at USD52.39, or the low of 12 Oct. This is followed by USD50.00, a round figure. Moving up, the immediate resistance is set at USD57.02, ie the high of 25 Sep. This is followed by USD59.54, which was the high of 19 Sep.

Source: RHB Securities Research - 1 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024