COMEX Gold - Bulls Likely Mean It This Time

rhboskres

Publish date: Fri, 01 Nov 2019, 09:04 AM

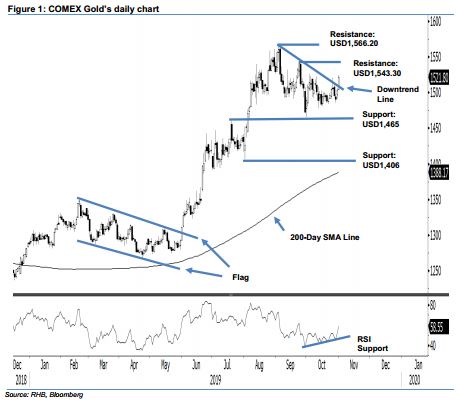

Maintain long positions on expectation of upward move resumption. The Comex Gold formed a white candle in the latest trade, which at the closing crossed above the downtrend line (as drawn on the chart). Intraday tone was encouraging, as it generally trended higher for the whole session. The low and high were recorded at USD1,503.30 and USD1,523.70, before closing USD18 stronger at USD1,521.80. The breakaway from the said downtrend line on the back of the RSI – which is edging higher – indicates the commodity’s upward move is getting traction. We are still holding the view that the COMEX Gold in on the path of extending its multi-quarter uptrend. Maintain our positive trading bias.

As the bulls are signalling a good possibility for the resumption of the multi-quarter upward move, we maintain our recommendation for traders to stay in long positions. These were initiated at USD1,513.80, or the closing level of 3 Oct. For risk-management purposes, a stop loss can be placed below the USD1,465.00 threshold.

Immediate support is expected at USD1,465.00, which was the low of 1 Oct. This is followed by the USD1,406.00 mark, ie near the low of 1 Aug. Conversely, the immediate resistance is set at USD1,543.30, or the high of 24 Sep. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 1 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024