E-mini Dow Futures - Taking a Breather

rhboskres

Publish date: Fri, 01 Nov 2019, 09:07 AM

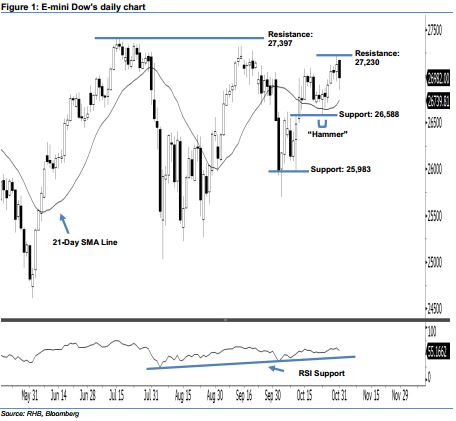

Maintain long positions. The E-mini Dow ended lower to form a black candle last night. It lost 150 pts to close at 26,982 pts, off its high of 27,180 pts and low of 26,847 pts. Yet, the bullish sentiment stays unchanged as this candle can only be viewed as buyers probably taking a breather after the recent gains. From a technical perspective, as the bullishness of 23 Oct’s “Hammer” pattern has not been negated, this shows that the selling momentum is considered weak. Overall, we remain bullish on the E-mini Dow’s outlook.

Currently, we maintain the immediate support level at 26,588 pts, ie the low of 23 Oct’s “Hammer” pattern. If a breakdown arises, look to 25,983 pts – ie the previous low of 10 Oct – as the next support. On the other hand, we are now eyeing the immediate resistance at 27,230 pts, determined from the high of 30 Oct. The next resistance would likely be at the 27,397-pt record high.

Hence, we advise traders to maintain long positions, given that we previously recommended initiating long above the 26,750-pt level on 16 Oct. A trailing-stop is preferably set below the 26,588-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 1 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024