FCPO - No Clear Price Exhaustion Signal

rhboskres

Publish date: Fri, 01 Nov 2019, 09:11 AM

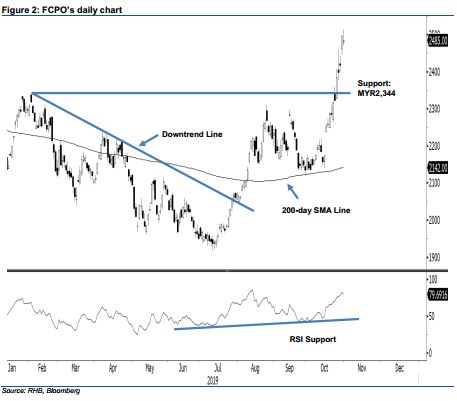

Maintain long positions as there is still no clear signal for a correction. The FCPO briefly tested the MYR2,500 immediate resistance level with an intraday high of MYR2,514. However, the commodity failed to sustain to this positive tone. At the closing, it fell MYR11 to MYR2,485. Despite the intraday negative price reversal from an area near the said immediate resistance, which happens on the back of an overbought RSI reading, there is no clear price signal to suggest that the commodity is due for a correction. Overall, the multi-month upward move is still showing signs of firmness. Maintain our positive trading bias.

Untill signs for a correction emerges, traders are advised to stay in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop loss can now be placed below MYR2,328.

The immediate support is maintained at MYR2,400. Breaking this may see market test MYR2,344, the high of 7 Feb. On the other hand, the immediate resistance is expected to emerge at MYR2,500, followed by MYR2,568, the high of 1 Mar 2018.

Source: RHB Securities Research - 1 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024