COMEX Gold - Looks Encouraging

rhboskres

Publish date: Mon, 04 Nov 2019, 09:57 AM

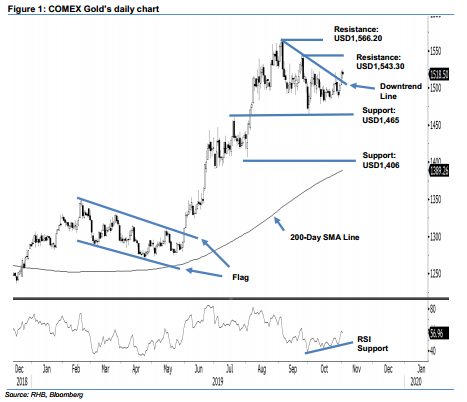

Maintain long positions as we are still expecting upward extension. The Comex Gold ceased the latest session USD3.30 weaker to close at USD1,518.50. This came after it reached a low and high of USD1,512.60 and USD1,525.20. The slightly weak session did not generate a negative signal, instead it can be seen as just a minor pause after the precious metal experienced a relatively good upward move in the prior two sessions. Broadly, we still believe the Comex Gold is on the path of resuming its multi-quarter upward move. Hence, we keep to our positive trading bias.

On the expectation that the multi-quarter upward move is ready to extend, we maintain our recommendation for traders to stay in long positions. These were initiated at USD1,513.80, or the closing level of 3 Oct. For riskmanagement purposes, a stop loss can be placed below the USD1,465.00 threshold.

We are keeping the immediate support at USD1,465.00, which was the low of 1 Oct. This is followed by the USD1,406.00 mark, ie near the low of 1 Aug. Moving up, the immediate resistance is set at USD1,543.30, or the high of 24 Sep. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 4 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024