WTI Crude Futures - Bulls Regain Control

rhboskres

Publish date: Mon, 04 Nov 2019, 09:59 AM

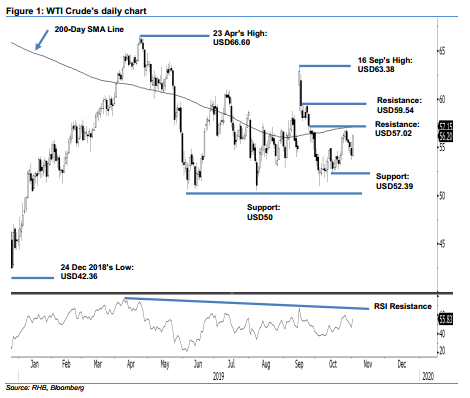

Initiate long positions as the bulls are likely giving the 200-day SMA line another try. The WTI Crude experienced a relatively strong session yesterday. It closed USD2.02 higher at USD56.20 – after reaching a low and high of USD54.07 and USD56.33. The positive performance has in our view likely signalled that the commodity’s recent retracement from the 200-day SMA area has reached to an end. This implies chances are now high for the black gold to re-challenge the said SMA. Recall that the said SMA line is a level that the bulls have struggled to overcome and hold above over the recent months. Switch our trading bias to positive.

Our previous short positions that were initiated at USD53.55 (the closing level of 10 Oct) were closed out at the breakeven in the latest session. On the bias that the bulls have regained control, we initiate long positions at the latest closing. For risk management purposes, a stop loss can be placed below USD52.39. ]

Immediate support is maintained at USD52.39, or the low of 12 Oct. This is followed by USD50.00, a round figure. On the other hand, the immediate resistance is set at USD57.02, ie the high of 25 Sep. This is followed by USD59.54, which was the high of 19 Sep.

Source: RHB Securities Research - 4 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024