FCPO - A Pause May Be On The Horizon

rhboskres

Publish date: Mon, 04 Nov 2019, 10:08 AM

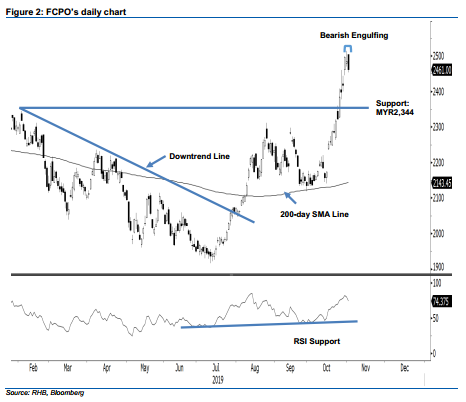

Maintain long positions as a minor pause may be developing. The FCPO closed on a weak note last Friday, having failed to hold on to its earlier session’s gain. During the session, it reached a high of MYR2,505, before closing MYR24 lower at MYR2,461. Consequently, a “Bearish Engulfing” formation was formed. The commodity has been attempting to cross the MYR2,500 resistance over the past three sessions on an overbought RSI. For now, we view that it is merely undergoing a minor pause, until signs of a deeper correction surface. We maintain our positive trading bias.

In the absence of negative price signals that could suggest the possibility for a deeper correction to develop, traders are advised to remain in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop-loss can now be placed below MYR2,328.

We maintain the immediate support level at MYR2,400, followed by MYR2,344, the high of 7 Feb. Moving up, the immediate resistance is expected to emerge at MYR2,500, followed by MYR2,568, the high of 1 Mar 2018.

Source: RHB Securities Research - 4 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024