Hang Seng Index Futures - Third Consecutive White Candle

rhboskres

Publish date: Tue, 05 Nov 2019, 09:50 AM

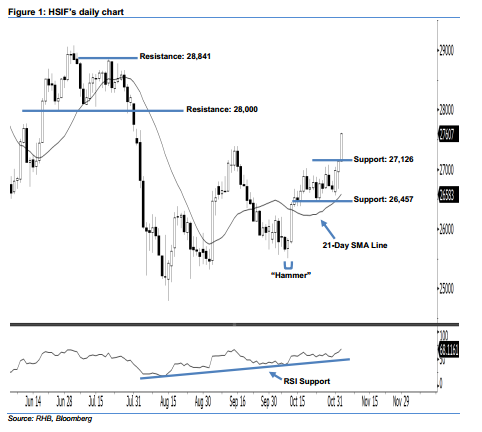

Uptrend is likely to persist; stay long. Buying momentum in the HSIF continued as expected, as a third consecutive white candle was formed yesterday. It surged 459 pts to close at 27,607 pts. From a technical perspective, the index has marked a higher close vis-à-vis the previous sessions since 31 Oct. This indicates that the rebound, which started from 10 Oct’s “Hammer” pattern, may continue. Furthermore, the index has breached above the 27,394-pt resistance mentioned previously, this has enhanced the positive sentiment. Overall, we stay bullish on the HSIF’s outlook.

According to the daily chart, we are now eyeing the immediate support level at 27,126 pts, ie the low of 4 Nov. If this level is taken out, look to 26,457 pts, which was the low of 23 Oct. On the other hand, the immediate resistance level is seen at the 28,000-pt psychological spot. Meanwhile, the next resistance is anticipated at 28,841 pts, determined from the high of 19 Jul.

Hence, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,150-pt level on 16 Oct. A trailing-stop can be set below the 26,457-pt mark in order to limit the downside risk.

Source: RHB Securities Research - 5 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024