FKLI - Crossing the 1,600-pt Mark

rhboskres

Publish date: Tue, 05 Nov 2019, 10:02 AM

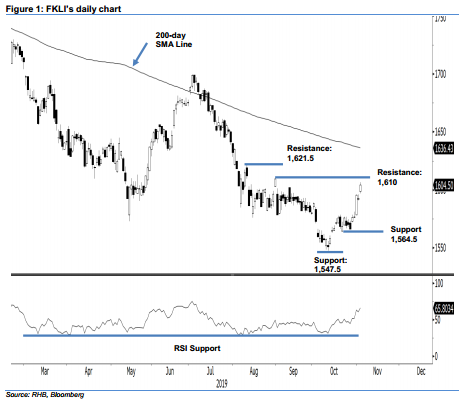

Countertrend rebound is extending; maintain long positions. The FKLI had a strong session yesterday, crossing above the previous immediate resistance of 1,600 pts, and settling 12.5 pts higher at 1,604.5 pts. The intraday tone was encouraging, as it generally scaled higher for the whole session, while the low and high were at 1,597 pts and 1,606.5 pts. The upside breach of the said previous immediate resistance suggests that the bulls still have firm control over the FKLI’s countertrend rebound. The rebound kicked in after the index completed its latest retracement leg which took place between early July and mid-October. As such, we maintain our positive trading bias.

As the countertrend rebound remains strong, traders are advised to remain in long positions. We initiated these at 1,565 pts, the closing level of 14 Oct. To manage risks, a stop-loss can be set at the breakeven level.

The immediate support is revised to 1,564.5 pts, the low of 21 Oct. This is followed by 1,547.5 pts, the low of 10 Oct. Meanwhile, the immediate resistance is now pegged at 1,610 pts, the high of 30 Aug. This is followed by 1,621.5 pts, which was the high of 9 Aug.

Source: RHB Securities Research - 5 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024