FCPO - Negative Intraday Reversal

rhboskres

Publish date: Wed, 06 Nov 2019, 05:10 PM

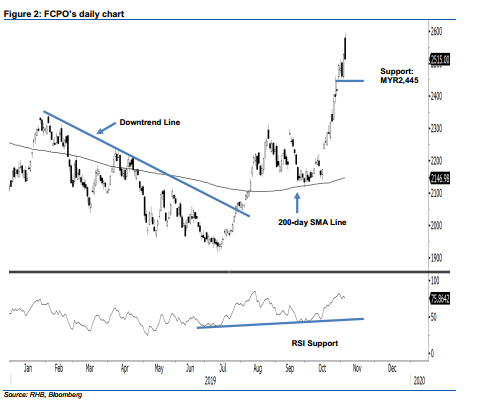

Maintain long positions, until signs of a deeper retracement emerge. The FCPO underwent a negative intraday price reversal after briefly crossing the immediate resistance of MYR2,568 with an intraday high of MYR2,594. At the close, it settled MYR14 weaker at MYR2,515. The negative price reversal came after the commodity’s upward move over the past weeks reached an overbought RSI reading. However, based on the daily chart, further negative price actions are needed to signal that a deeper retracement may develop.

Until we see signs of this emerging, we maintain our negative trading bias. Until there is confirmation that a deeper retracement is developing, traders should remain in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop-loss can now be placed below MYR2,445.

We are keeping immediate support at MYR2,445, the low of 30 Oct, followed by MYR2,400. Toward the upside, the immediate resistance is pegged at MYR2,568, the high of 1 Mar 2018, followed by MYR2,600.

Source: RHB Securities Research - 6 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024