COMEX Gold - Bulls Are Backing Away

rhboskres

Publish date: Wed, 06 Nov 2019, 05:12 PM

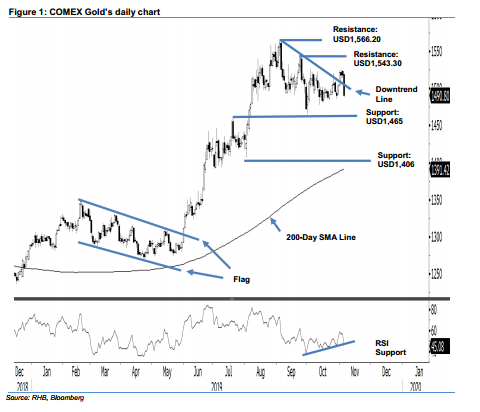

Maintain long positions until stop-loss is taken out. The Comex Gold experienced a relatively sharp decline in the latest trade. At the closing, it gave up USD27.50 to close at USD1,490.80 – back below both the downtrend line (as drawn on the chart) and the USD1,500 mark. The low and high were posted at USD1,487.70 and USD1,518.80. At this juncture we are still taking the view that the commodity is still ready to extend its multi-quarter upward move, this is despite the recent fake positive price signals. This positive bias would stay, provided the USD1,465 support level is not breached.

Until further negative price actions take place to invalidate our bias for the multi-quarter upward move to resume, we maintain our recommendation for traders to stay in long positions. These were initiated at USD1,513.80, or the closing level of 3 Oct. For risk-management purposes, a stop loss can be placed below the USD1,465.00 threshold.

We are keeping the Immediate support at USD1,465.00, which was the low of 1 Oct. This is followed by the USD1,406.00 mark, ie near the low of 1 Aug. Moving up, the immediate resistance is set at USD1,543.30, or the high of 24 Sep. This is followed by USD1,566.20, which was the high of 4 Sep

Source: RHB Securities Research - 6 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024