E-mini Dow Futures - Taking a Pause

rhboskres

Publish date: Wed, 06 Nov 2019, 05:14 PM

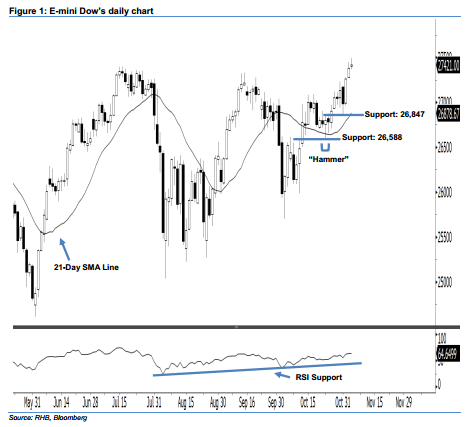

Bullish outlook remains intact; stay long. After the market posted two consecutive white candles in a row, the E-mini Dow formed a “Doji” candle last night. It rose 41 pts to close at 27,421 pts. Technically speaking, it is not surprising that buyers may be taking a breather following the recent gains. Since the 21-day SMA line is pointing upwards, this indicates that the market sentiment remains bullish. Overall, we think the upside swing that began with 23 Oct’s “Hammer” pattern would likely continue in the coming sessions.

As seen in the chart, the immediate support level is seen at 26,847 pts, which was 31 Oct’s low. The next support would likely be at 26,588 pts, determined from the low of 23 Oct’s “Hammer” pattern. To the upside, we maintain the immediate resistance level at the 27,500-pt round figure. If a breakout arises, the next resistance is anticipated at the 28,000-pt psychological spot.

Hence, we advise traders to maintain long positions, since we had originally recommended initiating long above the 26,750-pt level on 16 Oct. A trailing-stop is advisable to set below the 26,847-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 6 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024