Hang Seng Index Futures - the Rally Continues

rhboskres

Publish date: Thu, 07 Nov 2019, 05:51 PM

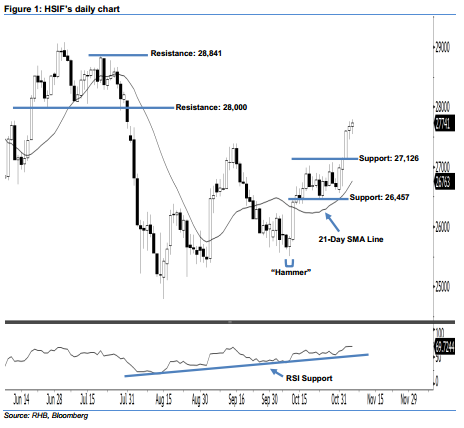

Stay long. The HSIF’s upward momentum continued as expected after it formed a fifth consecutive white candle yesterday. It rose to a high of 27,796 pts during the intraday session, before ending at 27,741 pts for the day. The index has marked a higher close vis-à-vis the previous sessions since 31 Oct, implying that the bullish trend remains intact. Yesterday’s candle sent the HSIF to its 3-month high – this is an indication that the rebound that started off 10 Oct’s “Hammer” pattern may carry on. Overall, we remain upbeat on the index’s outlook.

As shown in the chart, the immediate support level is anticipated at 27,126 pts, obtained from the low of 4 Nov’s long white candle. The next support would likely be at 26,457 pts, ie the low of 23 Oct. To the upside, the immediate resistance level is maintained at the 28,000-pt psychological spot. If a decisive breakout arises, the next resistance is seen at 28,847 pts, ie the high of 19 Jul.

Therefore, we advise traders to maintain long positions, given that we initially recommended initiating long above the 26,150-pt level on 16 Oct. A trailing stop set below the 27,126-pt threshold is preferable in order to secure part of the gains.

Source: RHB Securities Research - 7 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024