Hang Seng Index Futures - Snaps Six-Day Winning Streak

rhboskres

Publish date: Mon, 11 Nov 2019, 10:03 AM

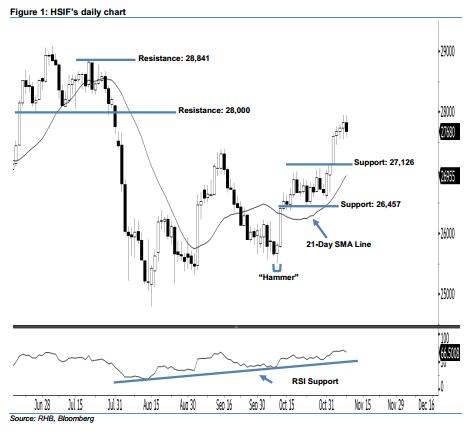

Stay long while setting a trailing-stop below the 27,126-pt support. Following the white candles that were formed on 31 Oct to 7 Nov, the HSIF ended lower to form a black candle last Friday. It settled at 27,680 pts, off its high of 27,938 pts and low of 27,591 pts. Unsurprisingly, last Friday’s black candle should merely be viewed as a result of profit-taking activities following the recent surge. Technically, we think the bulls may continue to control the market as long as the HSIF does not erase the gains from 4 Nov’s long white candle. Overall, we keep our bullish view on the HSIF’s outlook.

As shown in the chart, the immediate support level is seen at 27,126 pts, situated at the low of 4 Nov’s long white candle. The next support would likely be at 26,457 pts, determined from the low of 23 Oct. On the other hand, we maintain the immediate resistance level at the 28,000-pt psychological spot. If this level is taken out, look to 28,841 pts – ie the previous high of 19 Jul – as the next resistance.

Thus, we advise traders to maintain long positons, since we initially recommended initiating long above the 26,150- pt level on 16 Oct. A trailing-stop can be set below the 27,126-pt mark in order to secure part of the gains.

Source: RHB Securities Research - 11 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024