COMEX Gold - Immediate Support Gives Way

rhboskres

Publish date: Tue, 12 Nov 2019, 09:33 AM

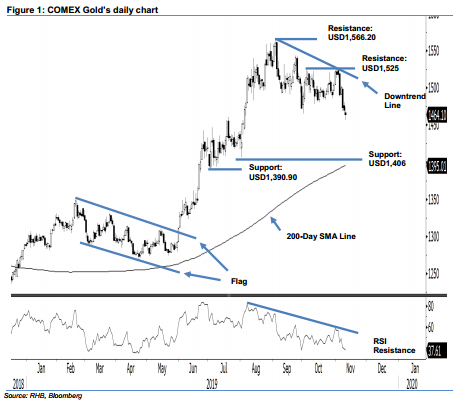

Initiate short positions as the case for resumption of a multi-quarter upward move is invalidated. The Comex Gold formed a black candle to settle the latest trade USD5.70 weaker at USD1,464.10 – slightly below the previous immediate support of USD1,465. Trading range was wide, between USD1,455.90 and USD1,474.10. The breakdown of the said previous immediate support has invalidated our previous expectation that the commodity would be on the path of resuming its multi-quarter upward move. Instead, the said breakdown suggests that the multi-month consolidation, which started from early September, is still extending. We switch our trading bias to negative.

Our previous long positions initiated at USD1,513.80 on 3 Oct were closed out at USD1,465.00. Given that the commodity is likely to trade in an extended correction phase, we initiate short positions at the latest closing. For risk-management purposes, a stop loss can be placed above USD1,525.00.

Immediate support is revised to the USD1,406.00 mark, ie near the low of 1 Aug. This is followed by USD1,390.90, the low of 1 Jul. Conversely, the immediate resistance is now pegged at USD1,525.00, the high of 3 Oct. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 12 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024