Hang Seng Index Futures - Triggers Short Positions

rhboskres

Publish date: Tue, 12 Nov 2019, 09:40 AM

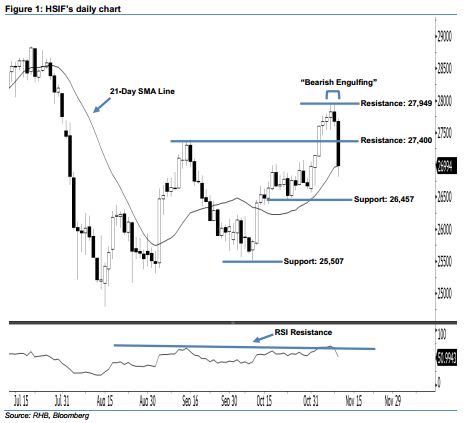

Initiate short positons below the 27,400-pt level. At the start of the week, the HSIF formed a long black candle, indicating that the selling momentum could be strong. It plunged 686 pts to close at 26,994 pts. As the index has formed a second consecutive black candle and closed below the previously-indicated 27,126-pt support, this indicates that market sentiment is turning bearish. The aforementioned long black candle can be viewed as a continuation of the bears extending the downside swing from 8 Nov’s “Bearish Engulfing” pattern. Yesterday’s closing also triggered our previous trailing-stop recommendation at the 27,126-pt mark – which has locked in part of the profits. Note that we initially advised on 16 Oct traders to initiate long above the 26,150-pt level.

We are presently eyeing the near-term resistance level at 27,400 pts, which is set near the midpoint of 11 Nov’s long black candle. This is followed by 27,949 pts, ie the high of 8 Nov’s “Bearish Engulfing” pattern. To the downside, the immediate support level is seen at 26,457 pts, which was defined from 23 Oct’s low. The next support will likely be at 25,507 pts, or the previous low of 10 Oct.

Hence, we advise traders to initiate fresh short positions below the 27,400-pt level. A stop-loss can be set above the 27,949-pt threshold to minimise the risk per trade.

Source: RHB Securities Research - 12 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024