FCPO - No Price Reversal Signal Yet

rhboskres

Publish date: Thu, 14 Nov 2019, 10:10 AM

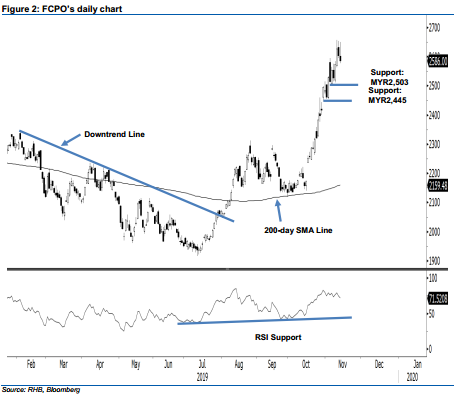

Trend remains firm; maintain long positions. The FCPO ceased the latest session softer by MYR18 at MYR2,586. Trading ranged between MYR2,577 and MYR2,650. The commodity’s soft price actions over the latest two sessions have yet to produce a price exhaustion signal. Instead, it is resembling the characteristics of a minor consolidation. This comes after its recent multi-week upward move reached an overbought RSI reading. Until further negative price actions take place in the coming sessions to signal an interim top for the said multi-week upward move, we are keeping our positive trading bias.

As the trend is still on strong footing, traders are recommended to remain in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop-loss can now be placed below MYR2,503.

The immediate support is pegged at MYR2,503, the low of 6 Nov. This is followed by MYR2,445, the low of 30 Oct. Moving up, the immediate resistance is pegged at MYR2,683, the high of 20 Nov 2017, followed by MYR2,758, the high of 16 Nov 2017.

Source: RHB Securities Research - 14 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024