Hang Seng Index Futures - Selling Momentum Resumes

rhboskres

Publish date: Thu, 14 Nov 2019, 10:05 AM

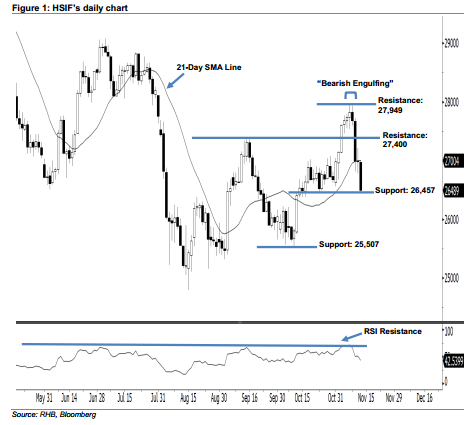

Maintain short positions, with a new trailing-stop set above the 27,400-pt resistance. The HSIF’s selling momentum has continued as expected, as the index ended lower to form a long black candle yesterday. It tumbled 495 pts to close at 26,489 pts. From a technical viewpoint, the HSIF has recorded a lower close vis-à-vis the previous sessions since 8 Nov. This indicates that the downside swing, which started from 8 Nov’s “Bearish Engulfing” pattern, may continue. Moreover, the 14-day RSI indicator declined below the 50 neutral point to flash a bearish reading at 42.54-pts, which implies that the bearish sentiment remains intact.

Currently, we maintain the immediate resistance level at 27,400 pts, ie near the midpoint of 11 Nov’s long black candle. The crucial resistance is seen at 27,949 pts, which was the high of 8 Nov’s “Bearish Engulfing” pattern. To the downside, the near-term support level is anticipated at 26,457 pts, defined from 23 Oct’s low. This is followed by 25,507 pts – obtained from the previous low of 10 Oct.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 27,400-pt level on 12 Nov. For now, a new trailing-stop can be set above the 27,400-pt mark as well in order to minimise the risk per trade.

Source: RHB Securities Research - 14 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024