Hang Seng Index Futures - Persistent Downward Momentum

rhboskres

Publish date: Fri, 15 Nov 2019, 08:41 AM

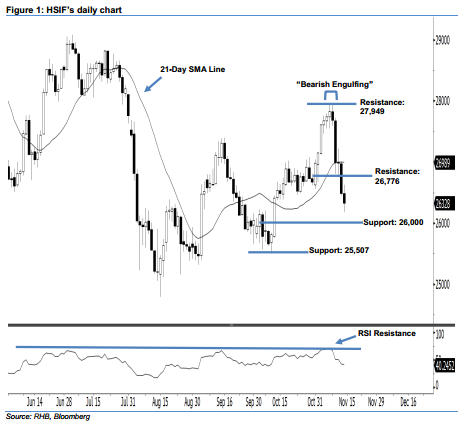

Stay short, with a new trailing-stop set above the 26,776-pt level. The downward momentum in the HSIF continued as expected. Another black candle was formed yesterday, which pointed towards a continuation of the downside move. It lost 161 pts to close at 26,328 pts. On a technical basis, investor sentiment remains bearish, as the HSIF has breached below the previously-indicated 26,457-pt support and hit its 1-month low. Overall, we expect the market to decline further if the immediate 26,000-pt support is taken out decisively in the coming sessions.

As seen in the chart, we now anticipate the immediate resistance level at 26,776 pts, situated near the midpoint of 13 Nov’s long black candle. Meanwhile, the crucial resistance is maintained at 27,949 pts, obtained from the high of 8 Nov’s “Bearish Engulfing” pattern. On the other hand, the immediate support level is seen at the 26,000-pt psychological mark. The next support is set at 25,507 pts, ie the previous low of 10 Oct.

To re-cap, on 12 Nov, we initially recommended traders to initiate short positions below the 27,400-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 26,776-pt threshold. This is in order to lock in part of the profits.

Source: RHB Securities Research - 15 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024