COMEX Gold - Bulls Have to Show More Muscles

rhboskres

Publish date: Fri, 15 Nov 2019, 08:46 AM

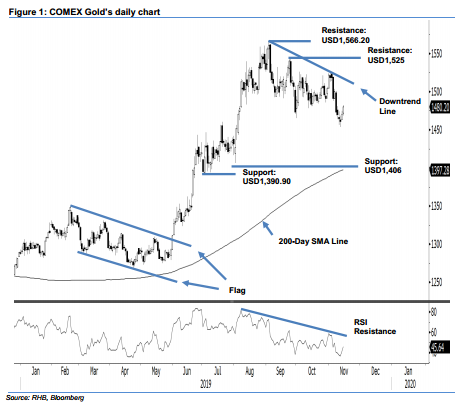

No clear sign for a reversal yet; maintain short positions. The Comex Gold formed a white candle to settle USD10 stronger at US1,480.20. Trading ranged between USD1,468.70 and USD1,482.20. The precious metal has been showing signs of a rebound in the latest three sessions. However, at this juncture, there is no clear technical evidence to indicate that the correction phase, which started in early September has reached an end. This is further supported by the fact it is still capped by the downtrend line (as drawn on the chart). Maintain our negative trading bias.

In the absence of price reversal signals, we recommended traders to stay in short positions. We initiated these at USD1,464.10, the closing level of 11 Nov For risk-management purposes, a stop loss can be placed above USD1,525.00.

Immediate support is set at the USD1,406.00 mark, ie near the low of 1 Aug. This is followed by USD1,390.90, the low of 1 Jul. Meanwhile, the immediate resistance is now pegged at USD1,525.00, the high of 3 Oct. This is followed by USD1,566.20, which was the high of 4 Sep

Source: RHB Securities Research - 15 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024