FCPO - Bulls Are Not Exhausted Yet

rhboskres

Publish date: Mon, 25 Nov 2019, 12:12 PM

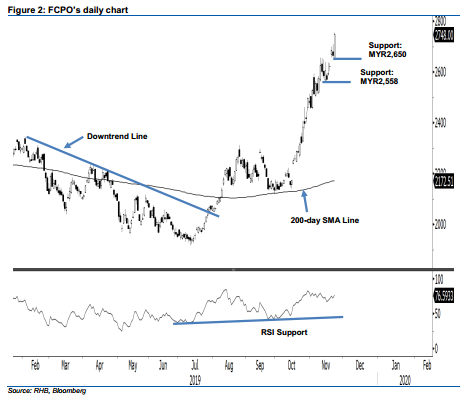

Maintain long positions as the bulls are powering ahead. The FCPO formed a white candle last Friday and, at the close, breached the previous immediate resistance point of MYR2,700. The intraday low and high were posted at MYR2,650 and MYR2,755, before ending MYR81 stronger at MYR2,748. The strong performance continues to signal that the bulls are still in firm control over the commodity’s multi-week uptrend. While the RSI is still flashing out an overbought reading, in the absence of adverse price actions that signal a price exhaustion (which implies that a correction may set in), we make no change to our positive trading bias.

As the momentum of increase is still strong and with the dearth of signs of an interim top, traders are advised to remain in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop-loss can be placed below MYR2,650, the latest session’s low.

Immediate support is revised to MYR2,650, the low of the latest session. This is followed by MYR2,558, the low of 14 Nov. On the other hand, the immediate resistance is now pegged at MYR2,800, followed by MYR2,855, which was the high of 30 Oct 2017.

Source: RHB Securities Research - 25 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024