E-mini Dow Futures - Bullish Trend Stays Intact

rhboskres

Publish date: Tue, 26 Nov 2019, 12:05 PM

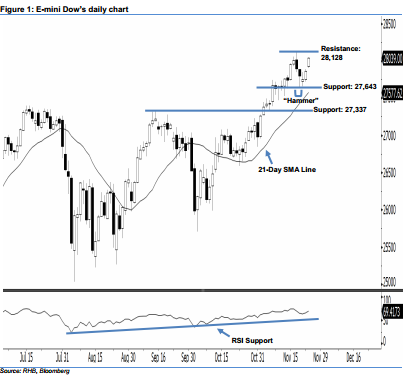

Stay long, with a new trailing-stop set below the 27,643-pt level. The upward momentum of the E-mini Dow continued as expected, as a white candle was formed last night. It gained 177 pts to close at 28,039 pts, after oscillating between a high of 28,045 pts and low of 27,904 pts. From a technical perspective, the uptrend is likely to persist, as the index has posted a third consecutive white candle and marked a higher close above the rising 21- day SMA line. Overall, we expect the market to rise further if the immediate 28,128-pt resistance mentioned previously is taken out decisively in the coming sessions.

Based on the daily chart, we now anticipate the immediate support level at 27,643 pts, determined from the low of 20 Nov’s “Hammer” pattern. The next support is seen at 27,337 pts, which was the low of 6 Nov. Towards the upside, the immediate resistance level is maintained at the 28,128-pt historical high. The next resistance is situated at the 28,500-pt round figure.

To re-cap, on 16 Oct, we initially recommended traders to initiate long positions above the 26,750-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 27,643-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 26 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024