FCPO - Bulls Are Holding On

rhboskres

Publish date: Thu, 28 Nov 2019, 05:48 PM

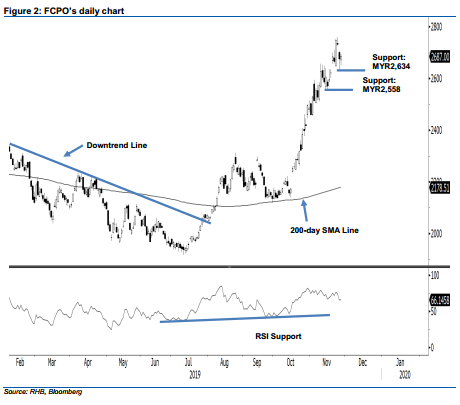

Maintain long positions as there is still no confirmation that a deeper correction will develop. The FCPO closed MYR11 higher, at MYR2,687, after ranging between MYR2,651 and MYR2,694. The latest performance suggests there is still no negative price signal to indicate the commodity is due for a deeper correction, following the recent two sessions’ weak performance. The said weak sessions have also placed the RSI reading back below the overbought reading. Until further adverse price actions appear, the multi-week uptrend is still considered intact. Premised on this, we keep to our positive trading bias.

As the momentum is still positive, traders are advised to stay in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop-loss can be placed below MYR2,634, the latest session’s low.

Immediate support should emerge at MYR2,634, the low of the latest session, followed by MYR2,558, the low of 14 Nov. Moving up, the immediate resistance is set at MYR2,800. Breaking this may see market test MYR2,855, ie the high of 30 Oct 2017.

Source: RHB Securities Research - 28 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024