FKLI - Hovering Around 50-Day SMA

rhboskres

Publish date: Fri, 29 Nov 2019, 06:31 PM

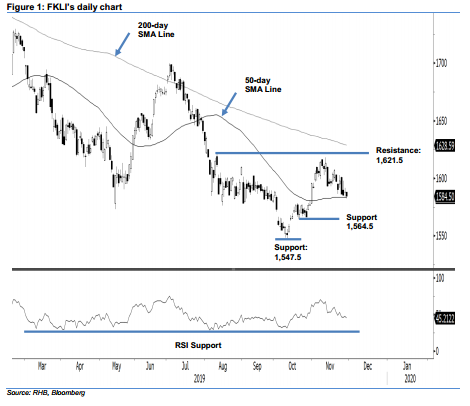

Maintain long positions as there is no clear breakdown from the 50-day SMA line. The FKLI shed 3.5 pts to close at 1,584.5 pts yesterday, after recording a low and high of 1,582.5 pts and 1,588 pts. As the close put it marginally below the 50-day SMA line, we do not regard it as a valid breakdown. A decisive breakdown from this SMA line could open the door for the multi-week correction phase to be extended further. For now, the index’s countertrend rebound remains valid, and may extend further once the multi-week correction is completed. We maintain our positive trading bias.

On expectation that the countertrend rebound still able to extend, traders are recommended to remain in long positions. We initiated these at 1,565 pts, the closing level of 14 Oct. To manage risks, a stop-loss can be set at the breakeven point.

We are keeping the immediate support target at 1,564.5 pts, the low of 21 Oct, followed by 1,547.5 pts, the low of 10 Oct. Moving up, the immediate resistance is still at 1,621.5 pts, the high of 9 Aug. This is followed by 1,635 pts, near the 200-day SMA line.

Source: RHB Securities Research - 29 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024