FCPO - Trend Is Still Positive

rhboskres

Publish date: Tue, 03 Dec 2019, 09:50 AM

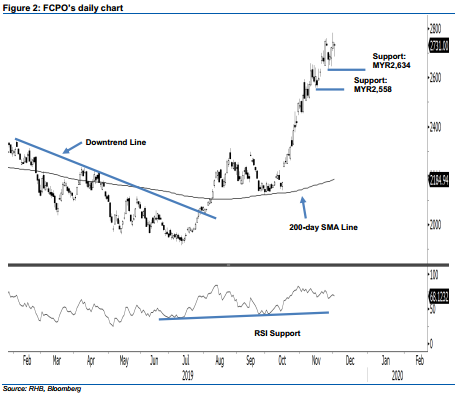

No sign for a deeper correction; maintain long positions. The FCPO eased MYR13 to close at MYR2,731, this came after it managed to narrow its intraday losses – the low was posted at MYR2,685. The soft session can be seen as a sign that bulls are taking a minor pause. It did not generate a price exhaustion signal that could suggest a correction phase is developing. We still believe the commodity’s multi-week upward move is still intact and could still be extending. This bias would stay provided the immediate support of MYR2,634 is not breached towards the downside. Maintain our positive trading bias.

As the bulls are still in control over the said multi-week upward move, traders are advised to remain in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop-loss can be placed below MYR2,634.

The immediate support is set at MYR2,634, the low of 26 Nov. Breaking this may see the market test MYR2,558, the low of 14 Nov. Conversely, the immediate resistance is set at MYR2,800, followed by MYR2,855, ie the high of 30 Oct 2017.

Source: RHB Securities Research - 3 Dec 2019