Hang Seng Index Futures - the Selling Momentum Persists

rhboskres

Publish date: Mon, 02 Dec 2019, 10:12 AM

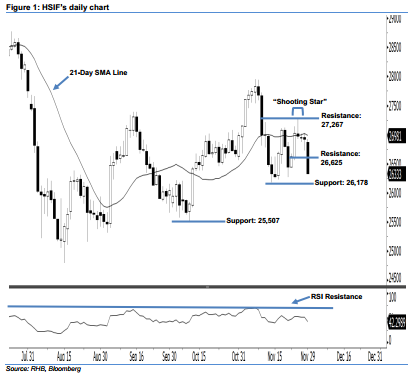

Stay short. The HSIF formed a long black candle last Friday, indicating strong selling activities. It tumbled 585 pts to close at 26,333 pts, off the session’s high of 26,918 pts. As seen in the chart, the index has marked a lower close vis-à-vis the previous sessions since 26 Nov, which implies the selling momentum has been extended. In view of the fact that the HSIF has hit its 1-week low indicates that the downside swing, which started off 26 Nov’s “Shooting Star” pattern, may persist. Overall, we keep our bearish view on the HSIF’s outlook.

Based on the daily chart, we now anticipate the immediate resistance level at 26,625 pts, which is set near the midpoint of 29 Nov’s long black candle. The next resistance will likely be at 27,267 pts, or the high of 26 Nov’s “Shooting Star” pattern. To the downside, the immediate support level is seen at 26,178 pts, ie 14 Nov’s low. The next support is situated at 25,507 pts, which was obtained from the previous low of 10 Oct.

Consequently, we advise traders to maintain short positions, since we originally recommended initiating short below the 26,630-pt level on 22 Nov. For now, a new trailing-stop can be set above 27,267-pt threshold to limit the risk per trade.

Source: RHB Securities Research - 2 Dec 2019