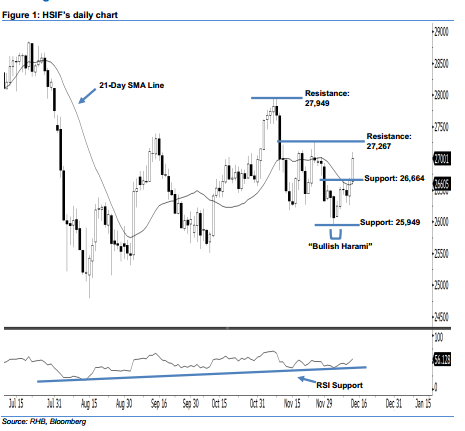

Hang Seng Index Futures - Forming a Second Consecutive White Candle

rhboskres

Publish date: Fri, 13 Dec 2019, 08:42 AM

Upside move is likely to persist; stay long. The upside move of the HSIF continued as expected, as a white candle was formed yesterday. It closed at 27,001 pts, after oscillating between a high of 27,095 pts and low of 26,588 pts. Market sentiment remains bullish in the coming sessions, as the index has posted a white candle for the second consecutive day. This may also further extend the rebound that started with 5 Dec’s “Bullish Harami” pattern. Overall, we stay upbeat on HSIF’s outlook. Judging from the current outlook, we now anticipate the immediate support level at 26,664 pts, ie the high of 9 Dec. If a breakdown occurs, look to 25,949 pts – which was the low of 5 Dec’s “Bullish Harami” pattern – as the next support. To the upside, the immediate resistance level is seen at 27,267 pts, determined from the high of 26 Nov. The next resistance is seen at 27,949 pts, ie the high of 7 Nov. Hence, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 26,500-pt level on 12 Dec. A stop-loss set below the 25,949-pt threshold is preferable in order to limit the downside risk.

Source: RHB Securities Research - 13 Dec 2019