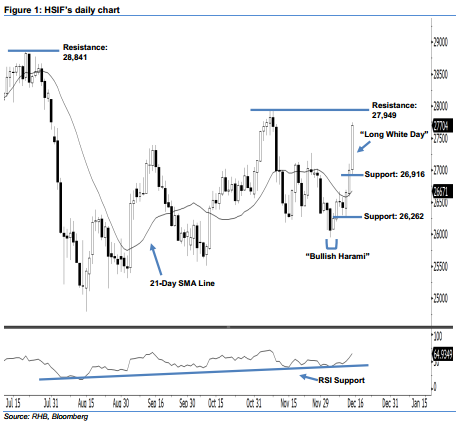

Hang Seng Index Futures - “Long White Day” Candlestick Emerges

rhboskres

Publish date: Mon, 16 Dec 2019, 09:44 AM

Stay long, with a new trailing-stop set below the 26,916-pt level. The buying momentum in the HSIF continued as expected, as a “Long White Day” candle formed last Friday. It surged 703 pts to close at 27,704 pts, off the session’s low of 26,916 pts. From a technical perspective, the index has marked a higher close vis-à-vis the previous sessions since 11 Dec. This indicates that the rebound, which started from 5 Dec’s “Bullish Harami” pattern, may continue. Furthermore, the HSIF has breached above the 27,267-pt resistance mentioned previously, which has enhanced the bullish sentiment. Overall, we stay bullish on the index’s outlook.

Presently, the immediate support level is seen at 26,916 pts, which is situated at the low of 13 Dec’s “Long White Day” candle. The next support is anticipated at 26,262 pts – determined from the low of 11 Dec. Conversely, we anticipate the immediate resistance level at 27,949 pts, ie 7 Nov’s high. Meanwhile, the next resistance is situated at 28,841 pts, which was the high of 19 Jul.

Therefore, we advise traders to stay long, given that we initially recommended initiating long above the 26,500-pt level on 12 Dec. For now, a new trailing-stop can be set below the 26,916-pt threshold to lock in part of the profits.

Source: RHB Securities Research - 16 Dec 2019