RHB Retail Research

Hang Seng Index Futures - Bullish Mode Remains Intact

rhboskres

Publish date: Fri, 20 Dec 2019, 09:52 AM

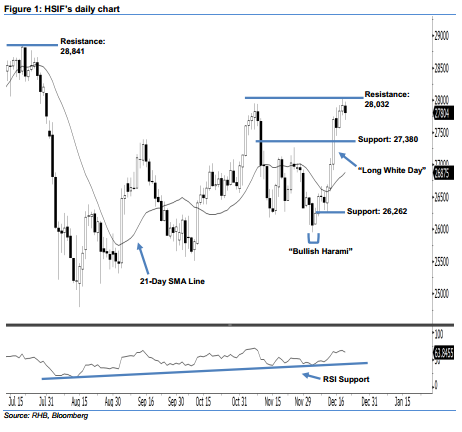

Bullish sentiment remains unchanged; stay long. The HSIF ended lower to form a black candle yesterday. It closed at 27,804 pts, off the session’s high of 27,976 pts. However, it was not surprising that there were profittaking activities after the recent surge. Since the 21-day SMA line is likely to turn higher, this indicates that investor sentiment remains bullish. Moreover, as the 14-day RSI indicator is now rising higher without being overbought, the bullish sentiment has improved.

As seen in the chart, we maintain the immediate support level at 27,380 pts – this is set near the midpoint of 13 Dec’s “Long White Day” candle. If this level is taken out, look to 26,262 pts – the low of 11 Dec – as the next support. Towards the upside, we are now eyeing the immediate resistance level at 28,032 pts, which was defined from 18 Dec’s high. Meanwhile, the next resistance will likely be at 28,841 pts, ie the previous high of 19 Jul.

Hence, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,500-pt level on 12 Dec. In the meantime, a trailing-stop can be set below the 27,380-pt threshold to secure part of the gains.

Source: RHB Securities Research - 20 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments