RHB Retail Research

E-mini Dow Futures - Surging to a Historical High

rhboskres

Publish date: Mon, 23 Dec 2019, 08:44 AM

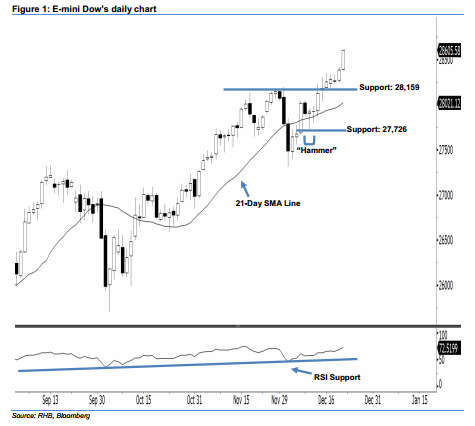

The bullish trend is likely to persist, stay long. The E-mini Dow’s upside move has continued as expected, as a second consecutive white candle was formed last Friday. It settled at 28,605.58 pts, off the session’s low of 28,373 pts. Based on the current technical landscape, last Friday’s close has taken out the 28,500-pt resistance mentioned previously – it also sent the index to its historical high. This indicates that the buying momentum has extended. Overall, we think the rebound that began from 10 Dec’s “Hammer” pattern may continue.

As seen in the chart, we are eyeing the immediate support level at 28,159 pts, which is set at the low of 16 Dec. If a breakdown arises, the crucial support is seen at 27,726 pts, or the low of 10 Dec’s “Hammer” pattern. To the upside, the near-term resistance level is now anticipated at the 29,000-pt psychological mark. This is followed by the 29,500-pt round figure.

Therefore, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 28,159-pt level on 17 Dec. In the meantime, a stop-loss can be set below the 27,726-pt mark to limit the downside risk.

Source: RHB Securities Research - 23 Dec 2019

More articles on RHB Retail Research

Discussions

Be the first to like this. Showing 0 of 0 comments