RHB Retail Research

FKLI - Still Positive

rhboskres

Publish date: Fri, 27 Dec 2019, 11:36 AM

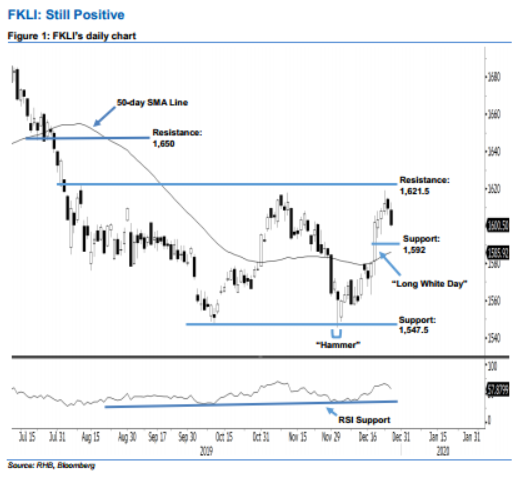

Market sentiment remains positive; stay long. The FKLI formed another black candle yesterday. It declined 9 pts to close at 1,600.50 pts, off its high of 1,612.50 pts and low of 1,599.50 pts. However, we maintain our positive sentiment, as the FKLI is still trading above the 1,592-pt support mentioned previously. That said, as long as the index does not erase more than 50% of its gains from 18 Dec’s “Long White Day” candle, this would show that the market’s upside swing is not diminished yet. Overall, we remain bullish in our outlook.

Based on the daily chart, the immediate support level is seen at 1,592 pts, set near the midpoint of 18 Dec’s “Long White Day” candle. The next support would likely be at 1,547.50 pts, defined from the previous low of 10 Oct. Towards the upside, the immediate resistance is anticipated at 1,621.50 pts, ie the high of 9 Aug. Meanwhile, the next resistance is situated at the 1,650-pt round figure.

Hence, we advise traders to stay long, given that we had originally recommended initiating long above the 1,568-pt level on 9 Dec. A trailing-stop can set below the 1,592-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 27 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments