RHB Retail Research

FCPO - Inching Higher

rhboskres

Publish date: Fri, 27 Dec 2019, 11:37 AM

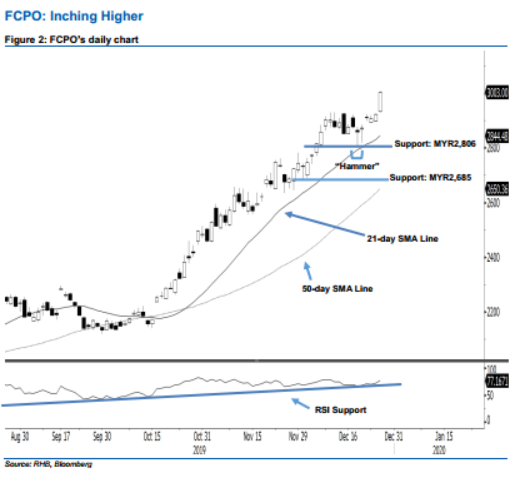

Stay long while setting a trailing-stop below the MYR2,806 support. Yesterday, the FCPO’s upward momentum continued as expected, after it formed a long white candle. It surged MYR80 to close at MYR3,003, off the session’s low of MYR2,930. Based on the current outlook, the upside trend would likely continue, as the commodity has posted a third consecutive white candle. Moreover, yesterday’s long white candle recorded the highest point in more than two years, which has enhanced the bullish sentiment. Overall, we keep our bullish view on the FCPO’s outlook.

As seen in the chart, the immediate support level is maintained at MYR2,806, ie the low of 18 Dec’s “Hammer” pattern. The next support would likely be at MYR2,685, which was the low of 2 Dec. On the other hand, we are eyeing the immediate resistance level at MYR3,075, determined from the previous high of 15 Feb 2017. The next resistance is anticipated at MYR3,202, obtained from the previous high of 19 Dec 2016.

Hence, we advise traders to stay long, in line with our initial recommendation to have long positions above the MYR2,175 level on 9 Oct. A trailing-stop can be set below the MYR2,806 threshold in order to lock in part of the profits.

Source: RHB Securities Research - 27 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments