RHB Retail Research

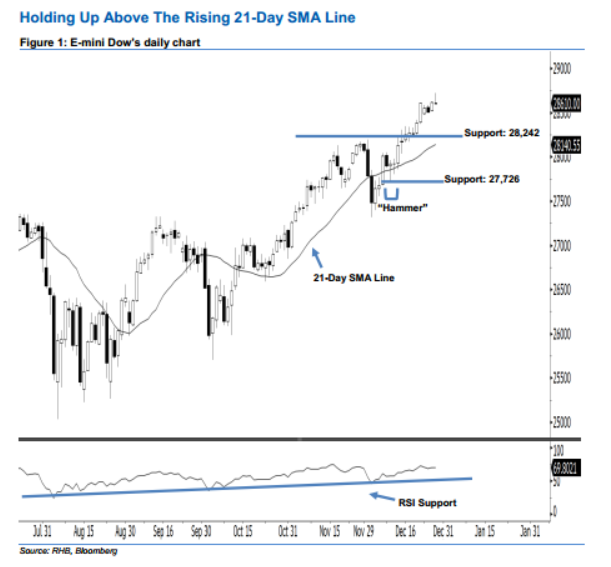

E-mini Dow Futures - Holding Up Above the Rising 21-Day SMA Line

rhboskres

Publish date: Mon, 30 Dec 2019, 11:36 AM

Stay long, with a new trailing-stop set below the 28,242-pt support. The E-mini Dow formed a “Doji” candle last Friday. It closed at 28,610 pts, after hovering between a high of 28,721 pts and low of 28,596 pts throughout the session. Presently, we maintain our bullish view, as the index has continued to stay above the rising 21-day SMA line. Meanwhile, judging from the current technical landscape, as long as the index does not erase the gains from 19-20 Dec’s white candles, the upside swing is still in effect. As such, we believe that the bulls still have control over the market.

We are now eyeing the immediate support level at 28,242 pts, determined from the low of 19 Dec. The next support would likely be at 27,726 pts, ie the low of 10 Dec’s “Hammer” pattern. On the other hand, the near-term resistance level is anticipated at the 29,000-pt psychological mark. This is followed by the 29,500-pt round figure.

Thus, we advise traders to stay long, in line with our initial recommendation to have long positions above the 28,159- pt level on 17 Dec. For now, a new trailing-stop can be set below the 28,242-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 30 Dec 2019

More articles on RHB Retail Research

Discussions

Be the first to like this. Showing 0 of 0 comments