WTI Crude Futures - No Clear Signal for Price Rejection

rhboskres

Publish date: Wed, 08 Jan 2020, 06:19 PM

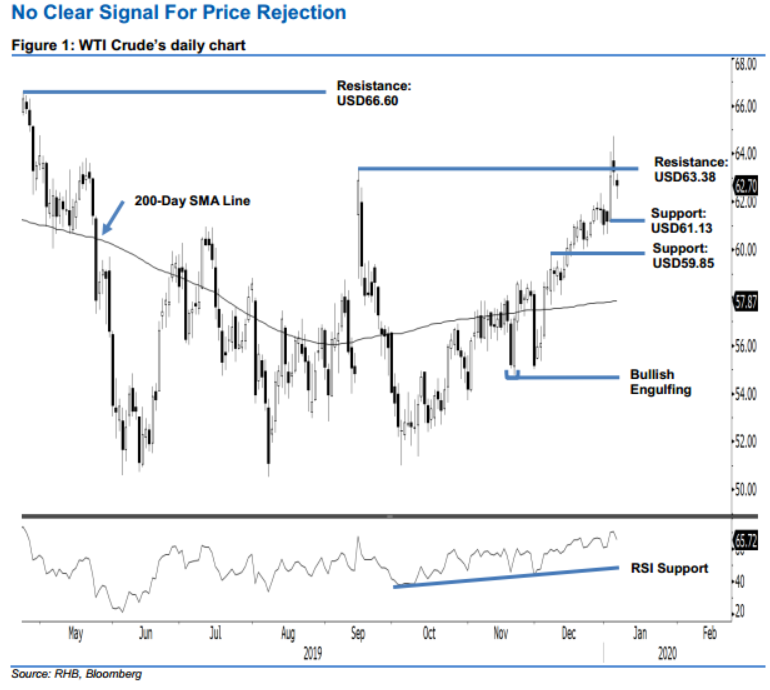

Maintain long positions, as there is no confirmation of the fake breakout. The WTI Crude ceased the latest session USD0.57 weaker at USD62.70. This came after it reached a low and high of USD62.11 and USD63.15. The weak session came after the commodity’s recent failure to decisively cross above the USD63.38 immediate resistance – heightening the risk of a price rejection from said resistance level. Based on the daily chart, to confirm a possible price rejection, the immediate support of USD61.13 has to be invalidated by the bears. Until this happens, we keep to our positive trading bias.

As there is still a lack of any price-rejection signals, we maintain our advice for traders to stay in long positions. We initiated these at USD59.20, or the closing level of 6 Dec 2019. For risk-management purposes, a stop-loss can now be placed below the USD61.13 threshold.

The immediate support is expected to emerge at USD61.13, or the low of 3 Jan. This is followed by USD59.85, which was the high of 6 Dec 2019. Moving up, the immediate resistance is eyed at the USD63.38 mark, ie the high of 16 Sep 2019. This is followed by USD66.60, which was the high of 23 Apr 2019.

Source: RHB Securities Research - 8 Jan 2020