WTI Crude Futures - Minor Bounce From 200-Day SMA

rhboskres

Publish date: Wed, 15 Jan 2020, 05:15 PM

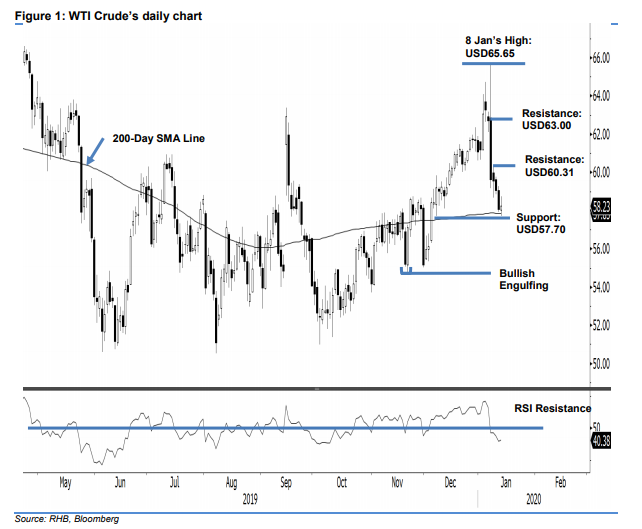

No price reversal signal spotted yet; maintain short positions. The WTI Crude ceased the latest session marginally better by USD0.15 at USD58.23. The session’s low and high were recorded at USD57.72 (nearing the immediate support of USD57.70) and USD58.72. At this juncture, the positive session can be seen as just a minor bounce from the 200-day SMA line. This means there is still no strong technical evidence to indicate the black gold’s sharp retracement that started from the high of USD65.65 has reached an end. Towards the downside, should a downside breach from the said SMA line occur, the negative bias could be further enhanced. Maintain our negative trading inclination.

Until clear price reversal signals from the said SMA line emerge, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can be placed at the breakeven level.

The immediate support is kept at USD57.70, which is near the 200-day SMA line. This is followed by the USD54.76 mark, or the low of 20 Nov 2019’s “Bullish Engulfing” pattern. Conversely, the immediate resistance is revised to USD60.31, the high of 9 Jan. This is followed by USD63.00, ie near the middle of 8 Jan’s candle.

Source: RHB Securities Research - 15 Jan 2020