WTI Crude Futures - Bears Struggling to Crack the 200-Day SMA

rhboskres

Publish date: Fri, 17 Jan 2020, 09:43 AM

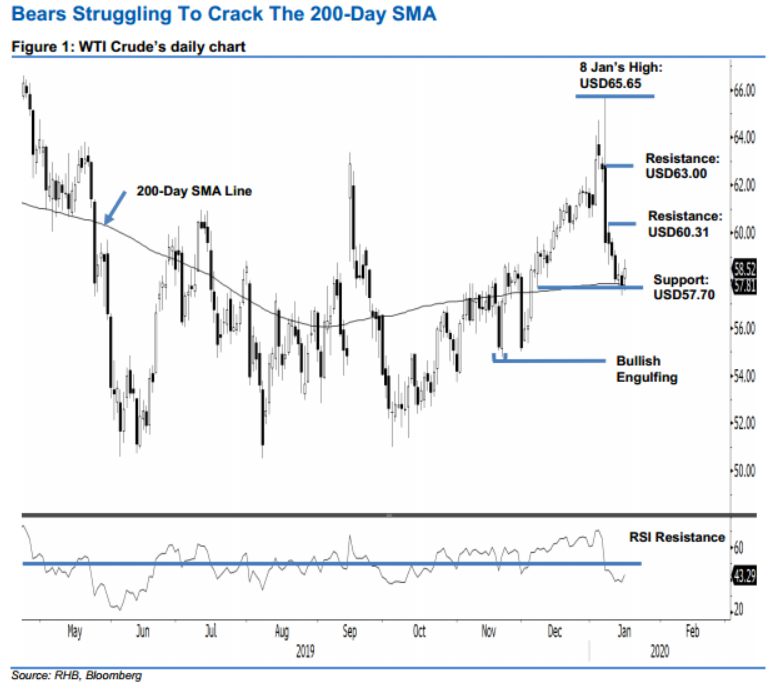

Maintain short positions until signs of an interim low emerges. The WTI Crude staged a positive intraday price reversal to close USD0.71 stronger at USD58.52. At one point it tested both the immediate support and 200- day SMA line with a low of USD57.56. The positive reaction from said levels can be seen as an early indication that the bulls are attempting to wrest control from the bears. However, to confirm the prospect of a rebound taking place, further positive price actions need to be observed in the coming sessions. For now, we stick to our negative trading bias.

Pending further positive price actions to mark the low of the retracement, which started from the high of USD65.65 recorded on 8 Jan, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can be placed at the breakeven level.

Immediate support is expected at USD57.70, which is near the 200-day SMA line. This is followed by the USD54.76 mark, or the low of 20 Nov 2019’s “Bullish Engulfing” pattern. Conversely, the immediate resistance is set at USD60.31, ie the high of 9 Jan. This is followed by USD63.00, or near the middle of 8 Jan’s candle.

Source: RHB Securities Research - 17 Jan 2020