E-mini Dow Futures - the Upward Momentum Resumes

rhboskres

Publish date: Thu, 20 Feb 2020, 04:53 PM

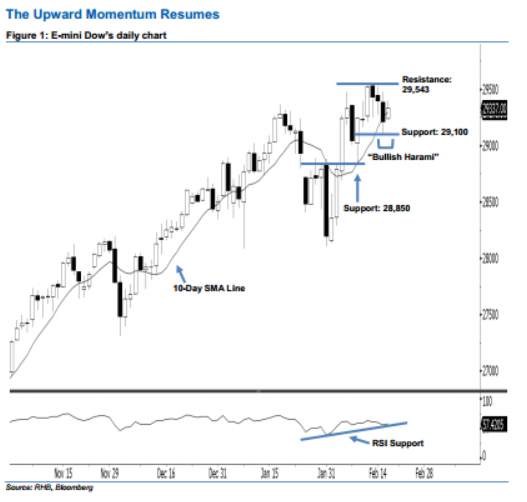

The market rebound is likely to persist; stay long. After posting three black candles in a row, the E-mini Dow ended higher last night to form a white candle. It rose 126 pts to close at 29,337 pts. From a technical viewpoint, we believe the buying momentum is still present, as the index has recouped most of the previous day’s losses. Given that the E-mini Dow has formed a “Bullish Harami” pattern on 18-19 Feb, this indicates a potential rebound. Overall, we expect the market to rise further if the immediate 29,543-pt resistance is taken out decisively in the coming sessions.

Based on the daily chart, we now anticipate the immediate support level at 29,100 pts this is set at the low of 19 Feb’s “Bullish Harami” pattern. The next support is seen at 28,850 pts, which was the previous low of 10 Feb. Towards the upside, the near-term resistance level is maintained at the 29,543-pt historical high. This is followed by the 30,000-pt psychological mark.

Hence, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 28,600-pt level on 5 Feb. For now, a trailing-stop can be set below the 29,100-pt threshold to lock in part of the profits.

Source: RHB Securities Research - 20 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024