COMEX Gold - a Minor Pause

rhboskres

Publish date: Thu, 05 Mar 2020, 05:33 PM

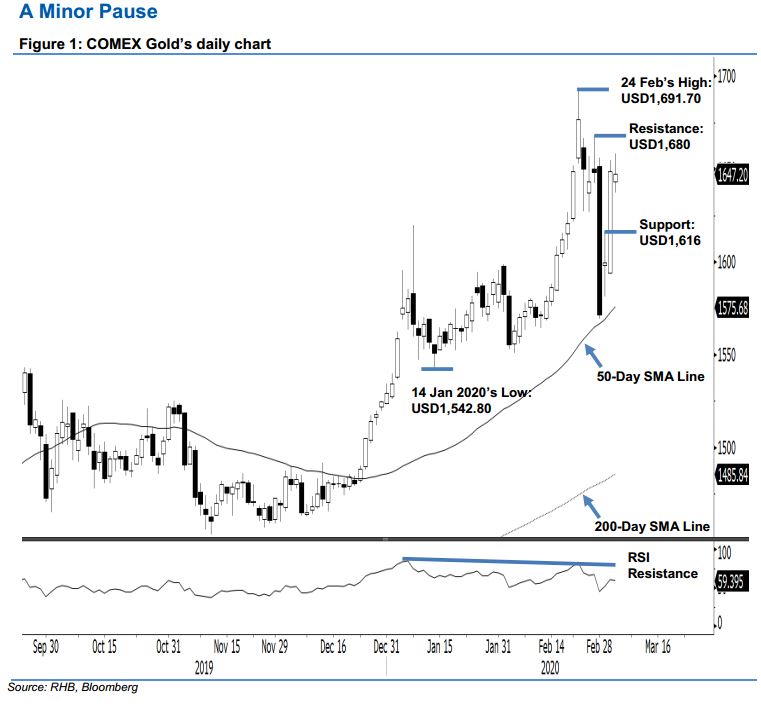

Maintain long positions, as the bulls are merely taking a breather. The COMEX Gold failed to sustain to its intraday gains – at one point it reached a high of USD1,658.60, before sliding to settle USD1.70 lower at USD1,647.20. The precious metal’s inability to hold on to such gains can be seen as just possible profit taking after the sharp upward moves over the recent two sessions from near the 50-day SMA line. It does not suggest a possible price exhaustion signal – this is further supported by the RSI reading, which is picking up but not overbought. Hence, we are keeping our positive trading bias.

As the multi-quarter positive trend is still likely to extend, we recommend traders stay in long positions. These were initiated at USD1,648.90, ie the closing level of 3 Mar. For risk-management purposes, a stop-loss can be placed below the USD1,616 mark.

The immediate support is maintained at USD1,631 and followed by USD1,616 – both are price points from 3 Mar’s candle. Moving up, the resistance levels are pegged at USD1,665, which was derived from 27 Feb’s candle. This is followed by USD1,680, ie the price traded on 25 Feb.

Source: RHB Securities Research - 5 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024