WTI Crude Futures - Bearish Tone Resuming

rhboskres

Publish date: Mon, 09 Mar 2020, 10:02 AM

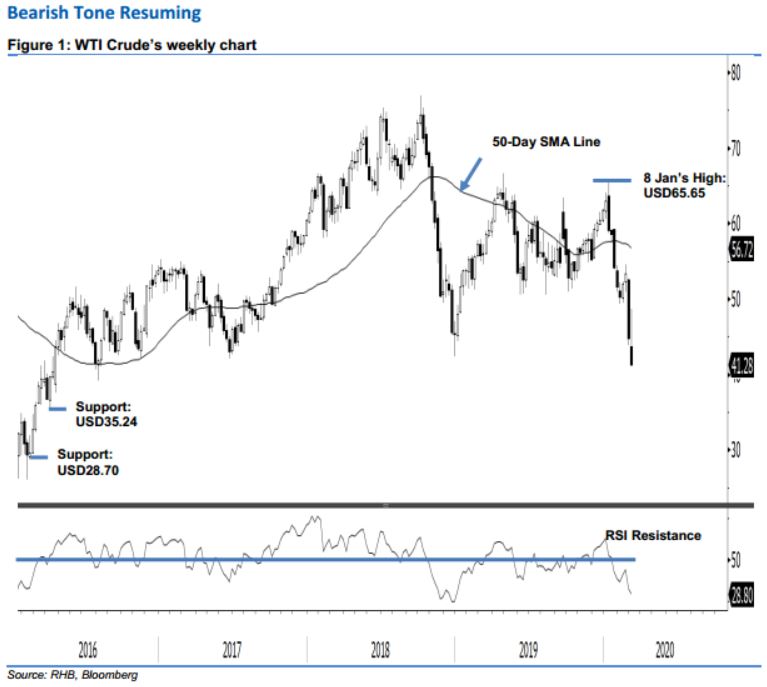

Maintain short positions. The WTI Crude ended the latest session sharply lower by USD4.62 at USD41.28. The high was posted at USD46.38. The previous support levels were also breached. The negative session means the retracement that started from the high of USD65.65 on 8 Jan is still progressing – despite the weekly RSI now flashing out an oversold reading. In the absence of a positive price reversal signal, we are keeping our negative trading bias.

As the latest weak performance has invalidated the bulls’ attempt to stage a rebound over the past week or so, we recommend traders stay in short positions. We initiated these at USD49.90, or the closing level of 25 Feb. To manage the risk, a stop-loss can be placed above the USD42.50 mark.

Support levels are eyed at USD35.24 (the low of 5 Apr 2016); USD32.32 (the low of 29 Feb 2016); USD30.00, a round figure; and USD28.70 (the low of 16 Feb 2016). Moving up, the resistance level is pegged at USD42.50, followed by USD44.00 – both are derived from the latest candle.

Source: RHB Securities Research - 9 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024