WTI Crude Futures - Minor Pause May be Taking Place

rhboskres

Publish date: Fri, 08 May 2020, 06:03 PM

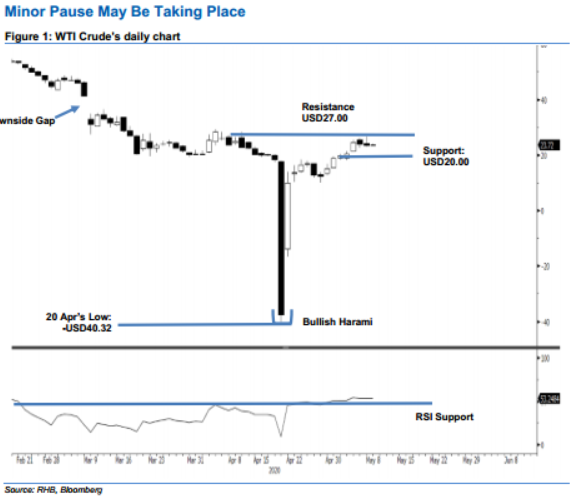

Maintain long positions while moving up the trailing-stop. The WTI Crude failed to sustain its intraday’s gains as it slid from a high of USD26.74 to close at USD23.55, indicating a decline of USD0.44. We see the negative intraday price reversal, which took place not too far away from the immediate resistance of USD27.00, as an indication that the commodity may be in the process of developing a minor consolidation. This was after it experienced a relatively sharp upward move over the past week or so – subsequent from 21 Apr’s “Bullish Harami” formation. There is no indication to suggest the rebound has reached its top and a sharp reversal may be taking place. Hence, we are keeping our positive trading bias.

As the counter-trend rebound may just be experiencing a minor consolidation, we maintain our long position recommendations while moving the trailing-stop loss to below USD20.00. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is revised to revised to USD22.00, the price point of 5 May – this is followed by USD20.00. Towards the upside, the immediate resistance is revised to USD25.00 – the price point of the latest session, followed by USD27.00.

Source: RHB Securities Research - 8 May 2020